Finding affordable property owner insurance can seem as if a formidable task, especially due to so many options available on the internet. As a landlord, making sure that your property is protected while maintaining costs manageable is essential. By using the appropriate approaches and a touch of investigation, you can secure a coverage that offers the coverage you need without having to stretching your financial plan.

In the modern digital age, the internet offers a wealth of tools to help you evaluate prices and coverage options for property owner insurance. Through utilizing internet-based tools and following some useful advice, you are able to maneuver through the coverage market effectively. Whether a seasoned property owner or just beginning, knowing how to locate the best offers can save you considerable sums of cash in the future.

Comprehending Landlord Coverage

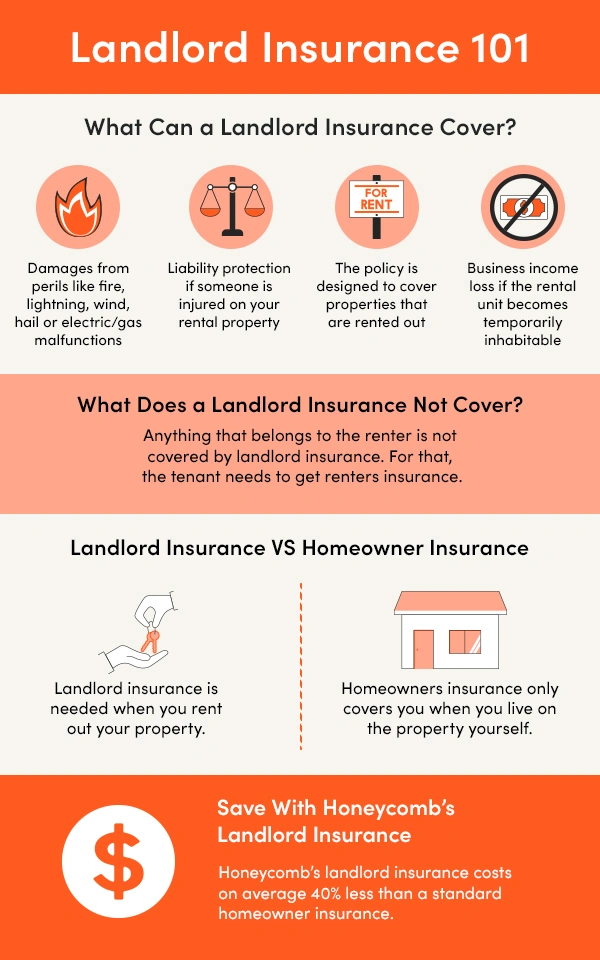

Landlord insurance is a tailored coverage designed to shield property owners renting out their residential or business properties. Unlike how do I get cheap landlord insurance online ’s coverage, property owner insurance focuses on the specific challenges that landlords face, such as structural damage, loss of rental income, and liability claims resulting from renter actions. This kind of insurance provides critical financial protection against unforeseen occurrences, such as extreme weather, vandalism, or even tenant-related lawsuits.

While deciding on a landlord insurance policy, it is important to comprehend the key elements commonly featured in the coverage. Many policies will include the actual structure of the leased premises, belongings needed for the rental, and liability protection in case a renter is damaged on the premises. Additionally, numerous property owners opt for coverage that comprises loss of rental income, making sure they are reimbursed if their home becomes uninhabitable due to an insured event.

Finding the best property owner insurance at an affordable rate necessitates careful analysis and evaluation. It is crucial to consider alternative providers and their products, as costs can fluctuate widely based on factors such as geography, classification of real estate, and coverage limits. Utilizing digital resources and platforms to contrast coverage options can help landlords choose wisely, guaranteeing they secure the essential coverage while avoiding strain on their budgets.

Locating Budget-friendly Choices

While looking for property insurance, it’s important to evaluate different policies from multiple providers to get the lowest prices. Begin by using online comparison tools that allow you to provide your real estate specifications and desired policy. These resources often provide estimates from various insurers, offering you a comprehensive summary of your possibilities. Ensure to check the feedback and ratings for each provider to verify dependability while maintaining expenses affordable.

Another efficient way to reduce expenses on property insurance is by finding savings that you may meet the criteria for. Many coverage companies give various types of reductions, such as bundling policies, having a claims-free history, or being a member of a professional association. By taking the time to check about these rebates, you might reduce your insurance cost dramatically and make sure you are securing the most advantageous offer on the market.

Finally, think about the extent of insurance you really need. Though it’s necessary to have adequate coverage, selecting a policy that provides only what is necessary can help in lowering costs. Assess your rentals and identify the threats specific to your case. For example, if your property is in a safe area, you may not need as comprehensive insurance. Customizing your coverage to your needs can help you save you cash without losing essential insurance.

Tips for Lowering Premiums

An effective practical way to reduce your landlord insurance premiums is to raise your deductible. A greater deductible means that you will pay more in cash in the event of a claim, but it can considerably lower your recurring premium. Before making this decision, evaluate your financial situation and how much you can handle to pay if an sudden incident arises. Weighing your risk with your savings can lead to considerable savings in the long run.

A further suggestion is to upgrade security and safety features in your rental property. Insurance companies often provide discounts for landlords who take assertive measures to minimize risks. Installing smoke detectors, alarm systems, and deadbolts can not only protect your property but also show to insurers that you are a trustworthy owner. This can cause lower premiums since the chance of claims may decrease.

Finally, compare options and analyze quotes from different insurance providers. Each company has its specific criteria for determining premiums, so it is essential to get several quotes to find the best deal. Look for any available discounts as well, such as those for multi-policy discounts or being a member of a reputable landlord association. Dedicate some time to this process, as it can lead to significant savings on your landlord insurance without losing coverage.